UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934 (Amendment

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ])]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement | ||||||||||

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||||||||

| [X] | Definitive Proxy Statement | ||||||||||

| [ ] | Definitive Additional Materials | ||||||||||

| [ ] | |||||||||||

| 14a-12 | |||||||||||

OAK ASSOCIATES FUNDS

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

Oak Associates Funds[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was

determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or

Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Proxy Materials

PLEASE CAST YOUR VOTE NOW!

OAK ASSOCIATES FUNDS

White Oak Select Growth Fund

Pin Oak Equity Fund

Rock Oak Core Growth Fund

River Oak Discovery Fund

Red Oak Technology Select Fund

Black Oak Emerging Technology Fund

Live Oak Health Sciences Fund(each, a “Fund” and collectively, the “Funds”)

38753800 Embassy Parkway, Suite 250

310, Akron, Ohio 44333

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON DECEMBER 10, 2019MARCH 4, 2024

October 7, 2019

Dear Shareholder:

We need your assistance. A special meetingNotice is hereby given that a Special Meeting of shareholdersShareholders (the “Special Meeting”) of the Funds (“Meeting”), each a series of the Oak Associates Funds (the “Trust”) will be held at the offices of Hanna Rasnick Evanchan Palmisano Hobson & Fox,Ultimus Fund Solutions, LLC, 388 South Main Street, Suite 402, Akron,2 Easton Oval #300, Columbus, Ohio 44311,43219, on December 10, 2019March 4, 2024 at 10:00 a.m.2:30 p.m. Eastern Time. The Special Meeting is being called for the purpose of considering the meeting isproposal set forth inbelow and to transact such other business as may be properly brought before the NoticeSpecial Meeting.

PROPOSAL: TO ELECT FIVE MEMBERS OF THE BOARD OF TRUSTEES OF THE TRUST.

Only shareholders of the Trust at the close of business on January 4, 2024 are entitled to notice of, and to vote at, the Special Meeting of Shareholders following this letter. Included with this letter are the Notice, a proxy statement and a proxy card.or any adjournment thereof.

We look forward to either receiving your proxy card so that your shares may be voted at the Special Meeting, or to your attendance at the Special Meeting. To vote, simply fill out the enclosed proxy card – be sure to sign, date and return it to us in the enclosed postage paid envelope. You also have the opportunity to provide voting instructions via telephone or the Internet. To vote by telephone please call the toll-free number located on your proxy card. To vote by using the Internet, please use the link located on your proxy card and follow the on-screen instructions.

Your vote is very important to us. Accordingly, a representative of the Trust may contact you to remind you of the voting deadline.

Thank you for your response and for your continued investment with the Trust and its Funds.

Oak Associates Funds

White Oak Select Growth Fund (WOGSX)Pin Oak Equity Fund (POGSX)Rock Oak Core Growth Fund (RCKSX)River Oak Discovery Fund (RIVSX)Red Oak Technology Select Fund (ROGSX)Black Oak Emerging Technology Fund (BOGSX)Live Oak Health Sciences Fund (LOGSX)(each, a “Fund” and collectively, the “Funds”)

3875 Embassy Parkway, Suite 250Akron, Ohio 44333

We encourage you to read the full text of the enclosed Proxy Statement. For your convenience we also have provided answers to frequently asked questions relating to, and a brief summary of, the proposal to be voted on by shareholders.

FREQUENTLY ASKED QUESTIONS

Q. What are shareholders being asked to vote upon?

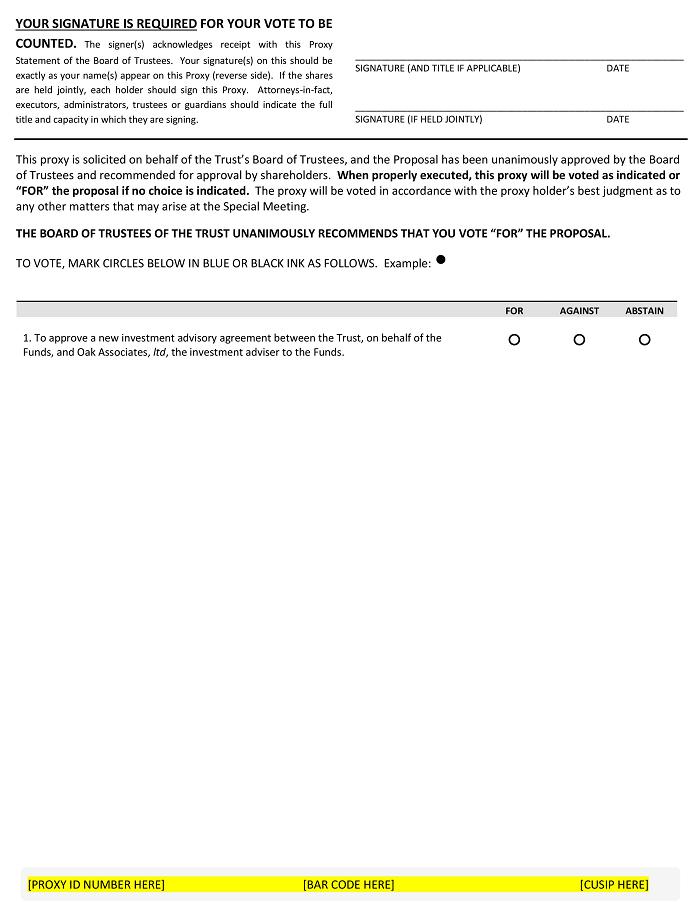

A. At the meeting scheduled for December 10, 2019, you will be asked to consider and vote on the following proposal:

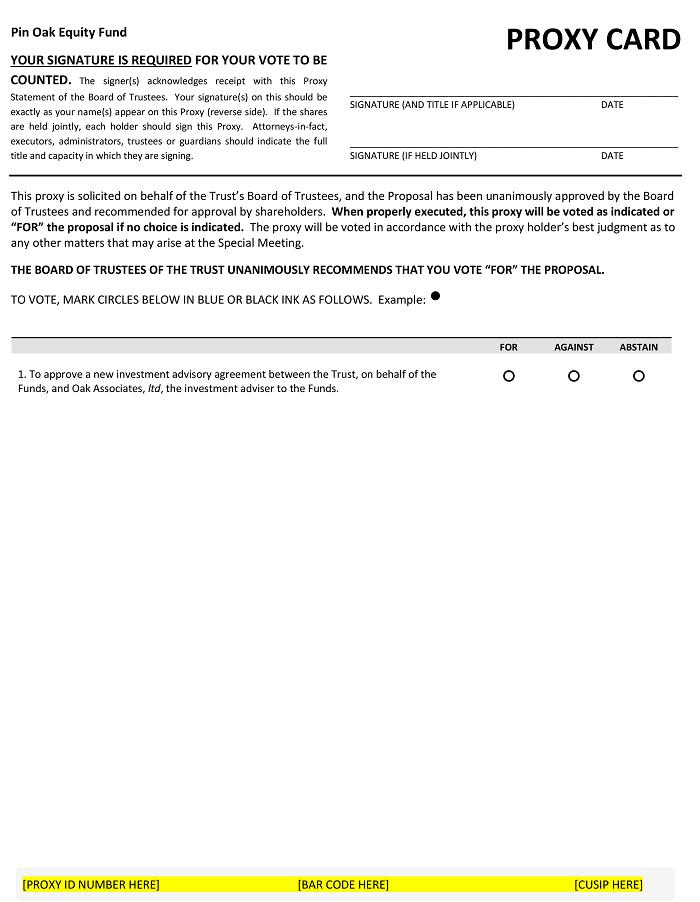

(1) To approve a new investment advisory agreement between the Oak Associates Funds (the “Trust”), on behalf of the Funds, and Oak Associates,ltd. (“Oak” or the “Adviser”), the investment adviser to the Funds (“New Agreement”).

Q. Who will manage the Fund prior to the approval of the proposed New Agreement?

A. Oak will continue to provide investment advisory services to the Funds pursuant to the current advisory agreement between the Adviser and the Trust (the “Current Agreement”).

Q. Who will manage the Fund after the approval of the proposed New Agreement?

A. Oak will continue to provide investment advisory services to the Funds pursuant to the New Agreement. The Transaction (defined below) is not expected to result in any change to the portfolio managers of the Funds, and Messrs. Oelschlager and Stimpson will continue to be jointly and primarily responsible for the day-to-day management of the Funds as Co-Chief Investment Officers. It is also expected that the Adviser will continue to employ substantially all of the firm’s existing staff following the completion of the Transaction, while providing the same services as under the Current Agreement.

Q. Why am I being asked to vote on a proposed New Agreement?

A. As part of ongoing long-term succession planning, James D. Oelschlager and Vanita Oelschlager, the owners of the Adviser, have agreed to sell substantially all of their collective ownership interest in the Adviser to an ownership group led by certain members of the Adviser’s management team - Robert D. Stimpson, Co-Chief Investment Officer of the Adviser, Margaret L. Ballinger, Chief Compliance Officer and Chief Operating Officer of the Adviser and Carol L. Zollars, Chief Financial Officer of the Adviser (the “Transaction”). The Transaction will result in a change of control of the Adviser, with Mr. Stimpson and Mmes. Ballinger and Zollars owning substantially all of the voting interests. The Transaction is not expected to result in any change to the portfolio managers of the Funds, and Messrs. Oelschlager and Stimpson will continue to be jointly and primarily responsible for the day-to-day management of the Funds as Co-Chief Investment Officers. Additionally, it is expected that the Adviser will continue to employ substantially all of the firm’s existing staff following the completion of the Transaction.

The Transaction will occur on or about December 31, 2019. The Transaction is deemed to be a “change in control” of the Adviser for the purpose of the Investment Company Act of 1940, as amended (the “1940 Act”). As a result of the Transaction, the Current Agreement will automatically terminate on December 31, 2019, or such other date of the Transaction. Based on this, and in light of its conclusions described in the Proxy Statement, the Adviser proposes that the Current Agreement be replaced with a new agreement with the Adviser that would cover the same services currently provided to the Funds under the Current Agreement. The material provisions of the Current Agreement and the New Agreement are the same. In comparison with the Current Agreement, the New Agreement incorporates certain additional provisions that memorialize and make explicit certain functions and duties of the Adviser that were implicit in the Current Agreement, and incorporates certain regulatory requirements that have gone into effect since the Current Agreement was initially entered into at the Funds’ inception. Additionally, the New Agreement updates the relevant dates of execution, effectiveness and termination. Each Fund’s advisory fee rate will remain unchanged. The New Agreement will take effect immediately upon the completion of the Transaction. The New Agreement will not result in the services provided and the day-to-day management of each Fund by Oak to change.

To enable the Adviser to continue serving as adviser to the Funds, at an in-person meeting of the Board of Trustees of the Trust (the “Board”) held on August 14, 2019, the Board, including a majority of the Trustees who are not “interested persons” (as that term is defined in the 1940 Act) of the Funds (the “Independent Trustees”), approved the New Agreement. Under the 1940 Act, the approval of a Fund’s New Agreement also requires the affirmative vote of a “majority of the outstanding voting securities” of such Fund. Accordingly, you are being asked to approve the New Agreement. The Transaction is not expected to occur prior to obtaining such approval. The Adviser will continue to manage the Funds pursuant to the Current Agreement until the New Agreement is approved by shareholders and the Transaction is complete.

Q. How does the change of control affect me?

A. The change of control is not expected to have an impact on the services received by the Funds, the operations of Oak or the fees payable by the Funds to Oak.

Q. Will there be any changes to the Funds’ investment policies, strategies or risks in connection with the New Agreement?

A. No. Each Fund’s investment policies, strategies, and risks will not change as a result of the New Agreement.

Q. Will the Proposal affect the investments made by the Funds?

A. No. Approval of the Proposal by a Fund’s shareholders will not have any effect on the principal investment strategies used by such Fund.

Q. Will the Proposal result in any change in the fees or expenses payable by the Funds?

A. No. Approval of the proposal by a Fund’s shareholders will not affect the fees or expenses payable by such Fund. If the New Agreement is approved by a Fund’s shareholders, such Fund will pay Oak a management fee equal to the management fee currently being paid.

Q. What happens if the proposed New Agreement is not approved?

A. If the shareholders of the Funds do not approve the New Agreement, the Transaction may be delayed and the Board will take such further action as it deems to be in the best interests of the shareholders of the Funds, which may include further solicitation of the Funds’ shareholders to approve the New Agreement.

Q. How does the Fund’s Board of Trustees recommend that I vote?

A. After careful consideration, the Board recommends that you vote FOR the proposal on the enclosed proxy card.

Q. What vote is required to approve the proposal?

A. The New Agreement must be approved by a “vote of a majority of the outstanding voting securities” of each Fund. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the voting securities of a Fund entitled to vote thereon present at the Meeting or represented by proxy, if more than 50% of a Fund’s outstanding voting securities are present or represented by proxy; or (ii) more than 50% of the outstanding voting securities of a Fund entitled to vote thereon.

Q. Will my Fund pay for this proxy solicitation?

A. No. The Adviser or its affiliates will pay for the costs of this proxy solicitation, including the printing and mailing of the Proxy Statement and related materials.

Q. How do I place my vote?

A. You may use the enclosed postage-paid envelope to mail your proxy card. Please follow the enclosed instructions to utilize any of these voting methods. If you need more information on how to vote, or if you have any questions, please call the Funds’ proxy solicitation agent at the telephone number below.

Q. Whom do I call for more information?

A. Should shareholders require additional information regarding the proxy or replacement proxy card, they may contact AST Fund Solutions, the Fund’s proxy solicitor, at 1-800-581-5238. Representatives are available Monday through Friday 9 a.m. to 10 p.m. Eastern time.

YOUR VOTE IS IMPORTANT. THANK YOU FOR PROMPTLY RECORDING YOUR VOTE.

White Oak Select Growth FundPin Oak Equity FundRock Oak Core Growth FundRiver Oak Discovery FundRed Oak Technology Select FundBlack Oak Emerging Technology FundLive Oak Health Sciences Fund(each, a “Fund” and collectively, the “Funds”)

3875 Embassy Parkway, Suite 250Akron, Ohio 44333

NOTICE OF SPECIAL MEETING OF SHAREHOLDERSTO BE HELD ON

DECEMBER 10, 2019

Important Notice Regarding the Availability of Proxy Materials for the Meeting to Be Held on December 10, 2019. The proxy statement is available at www.proxyonline.com/docs/oak2019.pdf or by calling AST Fund Solutions, the Funds’ proxy solicitor, at 1-800-581-5238. The Funds’ annual report is also available on the Funds’ website at www.oakfunds.com/forms-information.

Notice is hereby given that a special meeting of shareholders (the “Meeting”) of Oak Associates Funds (the “Trust”) will be held at the offices of Hanna Rasnick Evanchan Palmisano Hobson & Fox, LLC, 388 South Main Street, Suite 402, Akron, Ohio 44311, on December 10, 2019 at 10:00 a.m., for the following purposes:

1. To approve a new investment advisory agreement between the Trust, on behalf of the Funds, and Oak Associates,ltd, the investment adviser to the Funds (“New Agreement”); and

2. To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof.

Shareholders of record on September 18, 2019, are entitled to receive notice of and to vote at the Meeting and any adjournment(s) thereof. Shareholders are cordially invited to attend the Meeting. Whether or not you expect to be present at the Special Meeting, please complete and promptly return the enclosed proxy card. Your vote is extremely important, no matter how large or small your holdings may be. A postage paid envelope is enclosed for your convenience so that you may return your proxy card as soon as possible. You may also vote easily and quickly by telephone by calling the toll-free number located on the enclosed proxy card or through the Internet as described in the enclosed proxy card. To do so, please follow the instructions included on your enclosedsuch proxy card. It is most important and in your interest for you to vote so that a quorum will be present and a maximum number of shares may be voted. If you have any questions about how to vote your proxy or about the Special Meeting in general, please call toll-free 1-800-735-3591. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

Shares represented by duly executed proxies will be voted in accordance with the instructions given. A shareholder may revoke a previously submitted proxy at any time prior to the Special Meeting by (i) a written revocation, which must be signed and include the shareholder’sshareholder's name and account number, received by the Secretary of the Trust at AST Fund Solutions, 55 Challenger Road,225 Pictoria Drive, Suite 201, Ridgefield Park, NJ 07660;450, Cincinnati, Ohio 45246; (ii) properly executing a later-dated proxy; or (iii) attending the Special Meeting and voting in person. In accordance with their own discretion, the proxies are authorized to vote on such other business as may properly come before the Special Meeting or any adjourned session(s) thereof.

The persons named as proxies will vote“FOR”adjournment those proxies which they are entitled to vote in favorBy Order of a proposal and will vote“AGAINST”adjournment those proxies to be voted against a proposal.the Trustees,

Your vote is important to us. Thank you for taking the time to consider this proposal./s/ Charles A. Kiraly

Charles A. Kiraly

President

Dated: January 18, 2024

October 7, 2019

IMPORTANT

We urge you to sign, date and return the enclosed proxy card in the enclosed addressed envelope, which requires no postage. Your prompt return of the enclosed proxy card may save the necessity of further solicitations. If you wish to attend the Meeting and vote your Shares in person at that time, you will still be able to do so. If you need directions to the Meeting location, please contact the Funds at (888) 462-5386.

Oak Associates Funds

OAK ASSOCIATES FUNDS

White Oak Select Growth Fund

Pin Oak Equity Fund

Rock Oak Core Growth Fund

River Oak Discovery Fund

Red Oak Technology Select Fund

Black Oak Emerging Technology Fund

Live Oak Health Sciences Fund(each, a “Fund” and collectively, the “Funds”)

38753800 Embassy Parkway, Suite 250

310, Akron, Ohio 44333

PROXY STATEMENT

January 18, 2024

FOR THE SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON DECEMBER 10, 2019MARCH 4, 2024

This proxy statement is furnished by the Board of Trustees of Oak Associates Funds (the “Trust”"Trust") and its portfoliosfunds (collectively, the “Funds”) in connection with the solicitation of proxies for use at the special meeting of shareholders of the Trust to be held on December 10, 2019,March 4, 2024, at 10:00 a.m.2:30 p.m. Eastern Time, or at any adjournment thereof (the “Meeting”“Special Meeting”), at the offices of Hanna Rasnick Evanchan Palmisano Hobson & Fox,Ultimus Fund Solutions, LLC, 388 South Main Street, Suite 402, Akron,2 Easton Oval #300, Columbus, Ohio 44311.43219. It is expected that the Notice of Special Meeting, this proxy statement, and a proxy card will be mailed to shareholders on or about October 7, 2019.January 24, 2024.

PURPOSESUMMARY

At the Special Meeting, all shareholders of the Trust's Funds, voting together, will be asked to vote to elect five individuals to the Board of Trustees of the Trust, three of whom are currently members of the Trust's Board of Trustees. If you do not expect to be present at the Special Meeting and wish your shares to be voted, please vote your proxy card by mail, telephone or Internet allowing sufficient time for the proxy card to be received on or before the date of the Special Meeting. If your proxy card is properly returned by that date, shares represented by your proxy will be voted at the Special Meeting in accordance with your instructions. HOWEVER, IF NO INSTRUCTIONS ARE SPECIFIED ON THE PROXY WITH RESPECT TO THE PROPOSAL, THE PROXY WILL BE VOTED “FOR” THE APPROVAL OF MEETINGTHE PROPOSAL AND IN ACCORDANCE WITH THE JUDGMENT OF THE PERSONS APPOINTED AS PROXIES UPON ANY OTHER MATTER THAT MAY PROPERLY COME BEFORE THE SPECIAL MEETING. A shareholder may revoke a previously submitted proxy at any time prior to the Special Meeting by (i) a written revocation, which must be signed and include the shareholder’s name and account number, received by the Secretary of the Trust at 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246; (ii) properly executing a later-dated proxy; or (iii) attending the Special Meeting and voting in person.

The Meeting is being called in orderclose of business on January 4, 2024 has been fixed as the record date (the “Record Date”) for the determination of shareholders entitled to ask shareholdersnotice of, each Fundand to consider and vote onat, the following proposal (the “Proposal”) which is described in greater detail in this Proxy Statement.

Proposal: To approve a new investment advisory agreement betweenSpecial Meeting. Each full share held entitles the Trust, on behalf of the Funds, and Oak Associates,ltd. (“Oak” or the “Adviser”), the investment adviser to the Funds (“New Agreement”).

The persons named in the accompanying proxy will vote the number of shares of beneficial interest (“Shares”) of the Fund represented by such proxy as directed or, in the absence of such direction,FORthe Proposal.

Shareholdersshareholder of record to one vote for each dollar invested. In other words, each shareholder of the Fundsrecord is entitled to one vote for each dollar (carried forward to two decimal places) of net asset value per share of a Fund held as of the close of business on September 18, 2019 (the “Record Date”) are entitled to attend and to vote at the Meeting. Shareholders are entitled to one vote for eachRecord Date. Each fraction of a share held and, each fractional share iswill be entitled to a proportionate fractional vote, with no Shares having cumulative voting rights. If you own shares in more than one Fund as of the Record Date, you may receive more than one proxy card. vote.

As of the Record Date, the Funds’Trust’s net assets and the approximate number of shares outstanding were as follows:

| SHARES OUTSTANDING |

Photographic identification will be required for admission to the Meeting.

Only one copy of this Proxy Statement will be mailed to households, even if more than one person in a household is a member of record. If you need additional copies of this Proxy Statement, please contact AST Fund Solutions, the Funds’ proxy solicitor, at 1-800-581-5238. If you do not want the mailing of this Proxy Statement to be combined with those for other members of your household, contact the Funds in writing at Oak Associates Funds, c/o Ultimus Fund Solutions, LLC, P.O. Box 46707, Cincinnati, Ohio 45246-0707 or calling toll-free 1-888-462-5386.

Additional information about the Funds is available in their prospectus, statement of additional information and annual report to shareholders. A copy of the most recent semi-annual and annual report for the Funds is available upon request, without charge, at www.oakfunds.com, by writing the Funds at Oak Associates Funds, c/o Ultimus Fund Solutions, LLC, P.O. Box 46707, Cincinnati, Ohio 45246-0707 or by calling 1-888-462-5386.

PROPOSAL 1: TO APPROVE A NEW INVESTMENT ADVISORY AGREEMENT BETWEEN THE TRUST, ON BEHALF OF THE FUNDS, AND OAK ASSOCIATES,ltd.

| White Oak Select Growth Fund | $367,480,678.16 | 2,912,681.961 |

| Pin Oak Equity Fund | $123,528,169.42 | 1,654,477.491 |

| Rock Oak Core Growth Fund | $10,854,328.66 | 656,097.691 |

| River Oak Discovery Fund | $23,244,043.07 | 1,404,565.189 |

| Red Oak Technology Select Fund | $551,658,097.58 | 14,554,233.668 |

| Black Oak Emerging Technology Fund | $54,382,442.36 | 7,965,423.601 |

| Live Oak Health Sciences Fund | $53,627,251.69 | 2,554,358.892 |

Introduction:EXPENSES

The expenses of the Special Meeting will be borne proportionately by each Fund based on the assets of such Fund. The solicitation of proxies will be largely by mail, but may include telephonic, Internet or oral communication by officers and service providers of the Trust. The Trust will also use EQ Fund Solutions, LLC a third-party solicitor firm, for additional assistance with the solicitation of proxies. The Trust expects to pay approximately $80,250 to EQ Fund Solutions, LLC for the solicitation of proxies. Persons holding shares as nominees will, upon request, be reimbursed by the Funds for their reasonable expenses incurred in sending soliciting materials to their principals.

UPON REQUEST, THE TRUST WILL FURNISH, WITHOUT CHARGE, A COPY OF THE TRUST'S ANNUAL REPORT AND THE MOST RECENT SEMI-ANNUAL REPORT SUCCEEDING THE ANNUAL REPORT, IF ANY, TO A SHAREHOLDER. ANNUAL REPORTS AND SEMI-ANNUAL REPORTS MAY BE OBTAINED BY WRITING TO THE TRUST AT OAK ASSOCIATES FUNDS, C/O ULTIMUS FUND SOLUTIONS, LLC, P.O. BOX 46707, CINCINNATI, OHIO 45246-0707 OR BY CALLING 1-888-462-5386.

DISCUSSION OF PROPOSAL

INTRODUCTION

At the Special Meeting, it is proposed that five (5) individuals be elected as Trustees to the Board of the Trust to hold office until their successors are appointed or duly elected and qualified, or until he or she sooner dies, resigns, retires or is removed in accordance with the Trust’s Declaration of Trust. Shareholders are being asked to elect Susan F. Akers, David J. Gruber, Jennifer E. Hoopes, Michael R. Shade, and Robert D. Stimpson (each, a “Nominee” and, collectively, the “Nominees”) as Trustees of the Trust. Messrs. Gruber and Shade and Ms. Akers are currently Trustees of the Trust (collectively, the “Current Trustees”) and have been nominated for re-election. Ms. Hoopes and Mr. R. Stimpson (each, a “Candidate” and, collectively, the “Candidates”) are not currently Trustees of the Trust. FOR THE REASONS DISCUSSED BELOW, THE BOARD, INCLUDING EACH OF THE TRUST'S INDEPENDENT TRUSTEES, RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" THE ELECTION OF ALL FIVE NOMINEES.

GENERAL INFORMATION

The Trust’s Board of Trustees (“Board”)currently consists of the Oak Associates Funds (the “Trust”) is requesting that the shareholdersfive Trustees, four of the White Oak Select Growth Fund (“White Oak Fund”), Pin Oak Equity Fund (“Pin Oak Fund”), Rock Oak Core Growth Fund (“Rock Oak Fund”), River Oak Discovery Fund (“River Oak Fund”), Red Oak Technology Select Fund (“Red Oak Fund”), Black Oak Emerging Technology Fund (“Black Oak Fund”)whom, Messrs. Gruber and Live Oak Health Sciences Fund (“Live Oak Fund”) (each, a “Fund”Shade and collectively, the “Funds”) approve a new investment advisory agreement between the Trust, on behalf of the Funds,Mses. Akers and Oak Associates,ltd. (“Oak” or the “Adviser”) (the “New Agreement”). Oak is an investment adviser registered with the U.S. Securities and Exchange Commissions (“SEC”) and has provided investment advisory services to the Funds since their inception.

Background:

As part of ongoing long-term succession planning, James D. Oelschlager and Vanita Oelschlager, the owners of Oak, have agreed to sell substantially all of their collective ownership interest in the Adviser to an ownership group led by certain members of the Adviser’s management team - Robert D. Stimpson, Co-Chief Investment Officer of the Adviser, Margaret L. Ballinger, Chief Compliance Officer and Chief Operating Officer of the Adviser and Carol L. Zollars, Chief Financial Officer of the Adviser (the “Transaction”). The Transaction will result in a change of control of the Adviser, with Mr. Stimpson and Mmes. Ballinger and Zollars owning substantially all of the voting interests. As a result of the Transaction, Mr. Stimpson may be deemed to be the sole “control person” of the AdviserRamig, are not “interested persons,” as thatsuch term is defined in section 2(a)(9) ofunder the Investment Company Act of 1940, as amended (“1940(the “1940 Act”). The Transaction is not expected to result in any change to the portfolio managers, of the Funds,Trust (an “Independent Trustee”), and Messrs.one of whom, Mr. Oelschlager, and Stimpson will continue to be jointly and primarily responsible for the day-to-day management of the Funds. Additionally, it is expected that the Adviser will continue to employ substantially all of the firm’s existing staff following the completion of the Transaction.

The Transactionan “interested person,” as such term is expected to occur on or about December 31, 2019. The Transaction is deemed to be a “change in control” of the Adviser and therefore will constitute an “assignment”defined under the 1940 Act, of the current advisory agreement betweenTrust (an “Interested Trustee”). In light of Mr. Oelschlager’s and Ms. Ramig’s intention to retire from the AdviserBoard of Trustees immediately following the conclusion of the Special Meeting, with Mr. Oelschlager subsequently assuming the role of a Trustee Emeritus and remaining as Co-Chief Investment Officer of Oak Associates, ltd., investment adviser to the Trust, (the “Current Agreement”). Underthe Board has determined to add each of the Candidates to maintain its current composition of four independent trustees and one interested trustee.

Of the Trust’s current Board of Trustees, three have been elected by shareholder vote and two have been previously appointed by the Board. Mr. Oelschlager was previously elected to the Trust’s Board of Trustees by a vote of shareholders on May 12, 2000, and Mr. Shade and Ms. Ramig were previously elected by a vote of shareholders on August 1, 2007. Mr. Gruber was appointed to the Board on February 11, 2019, and Ms. Akers was appointed to the Board on May 9, 2022. Section 16(a) of the 1940 Act a party owning, directly or indirectly, more than 25% ofgenerally requires the voting securities of a company is presumed to control the company, and any transaction that results in such owner reducing its interest to less than 25% is presumed to constitute a change in controltrustees of an investment adviser. As a resultcompany be elected by shareholder vote. Section 16(a) provides, however, that trustees may be appointed by the Board without the election by shareholders if, immediately after such appointment, at least two-thirds of the Transaction,trustees then holding office have been elected by shareholders. If the two Candidates were appointed to the Board, immediately following such appointment only three of seven, or forty-three percent (43%), of the Board would be elected by shareholder vote, thus failing to meet the two-thirds requirement. Additionally, the retirement by either of Mr. Oelschlager or Ms. Ramig from the Board would leave Mr. Shade as the only elected Trustee and Section 16(a) would similarly require a special meeting be called to elect trustees in such an event. Therefore, shareholder approval is required to add the Candidates to the Board of Trustees. Accordingly, the Board has determined that it would be in the best interests of shareholders to call a special meeting at this time and recommend the election by shareholders of each Nominee.

On December 20, 2023, the Nominating Committee of the Trust met and considered the nomination of the Candidates. Mr. R. Stimpson and Ms. Hoopes were identified and recommended to the Trust’s Nominating Committee by Ms. Akers, an Independent Trustee and Chair of the Nominating Committee. Based on the Committee’s review and evaluation of each Candidate’s experience and qualifications, and the potential benefits to the Trust of adding a new Interested Director and Independent Director who could each add depth and breadth to the Board, the Committee nominated the Candidates to be presented to the Board of the Trust. The Committee also considered and evaluated the Current Agreement will automatically terminate on the date of the Transaction. The Current Agreement was last approved by the initial shareholder of each Fund immediately priorTrustees and determined to the commencement of operations of such Fund (for White Oak Select Growth Fund and Pin Oak Equity Fund, August 3, 1992; for Red Oak Technology Select Fund, December 31, 1998; for Black Oak Emerging Technology Fund, December 29, 2000; for Live Oak Health Sciences Fund, June 29, 2001; for Rock Oak Core Growth Fund, December 31, 2004; and for River Oak Discovery Fund, June 30, 2005). The continuation ofnominate the Current Agreement for an additional one-year term was last approved byTrustees to be presented to the Board of the Trust at an in-person meeting held on February 10-11, 2019, effective February 27, 2019.

At an in-person meeting held on August 14, 2019 (the “Board Meeting”), in anticipationto continue to serve as Trustees of the Transaction,Trust. At a meeting on the same day, the Board of the Trust approved the New Agreement. The New Agreement will not be effective until approved by a majority votenomination of each of the outstanding sharesNominees to serve as a Trustee of each Fund and the Transaction is complete. For the avoidance of doubt, each Fund will vote separately with respectTrust, subject to approval of his or her election by shareholders, as required under the New Agreement for such Fund. This Proposal is presented with respect1940 Act, and recommended to all Funds in a single proposal for easeshareholders that they approve the Nominees as Trustees of reading. The Adviserthe Trust.

If approved by shareholders at the Special Meeting, the Current Trustees will continue to manageserve as members of the Funds pursuant toBoard of Trustees of the Current Agreement until both the New Agreement isTrust. If approved by shareholders andat the Transaction is complete. IfSpecial Meeting, the New Agreement is not approved by the Funds’ shareholders, the BoardCandidates will consider alternatives for the Funds and take such actionbegin serving as it deems necessary and in the best interests of each Fund and its shareholders, which may include further solicitationmembers of the Funds’ shareholders to approve the New Agreement.

A discussion of the basis for the Board’s approval of the New Agreement is included below in the section entitled “Board Consideration in Approving the New Agreement.” The effective date of the New Agreement will be on or about the date both shareholders of a Fund approve the New Agreement and the Transaction is completed.The New Agreement will not increase advisory fees payable by the Funds to Oak. The Board of Trustees unanimously recommends that shareholders voteof the Trust immediately following the Special Meeting.

Each of the Nominees has consented to approve the New Agreement.being named in this proxy statement and serving as a Trustee if elected. The Trust knows of no reason why any Nominee would be unable or unwilling to serve if elected.

COMPARISON OF THE CURRENT AGREEMENT AND NEW AGREEMENTINFORMATION REGARDING NOMINEES

In comparison with the Current Agreement, the New Agreement incorporates certain additional provisions that memorialize and make explicit certain functions and duties of the Adviser that were implicit in the Current Agreement, and incorporates certain regulatory requirements that had gone into effect since the Current Agreement was initially entered into at the Funds’ inception. Additionally, the New Agreement updates the relevant dates of execution, effectiveness and termination. The stated investment advisory fees to be paid by thetable below provides basic information about each Nominee. The mailing address for each Nominee is c/o Oak Associates Funds, are identical under the Current Agreement and the New Agreement. A further comparison of the terms of the New Agreement and the Current Agreement is set forth below.3800 Embassy Parkway, Suite 310, Akron, Ohio 44333.

Name and Year of | Position(s) Held with Trust | Length of Time Served(1) |

During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Trustee(2) | Other Directorships Held by Trustee(3) | |||||||||||||||||

| NOMINEES FOR RE-ELECTION AS INDEPENDENT TRUSTEES (CURRENTLY SERVE AS INDEPENDENT TRUSTEES) | ||||||||||||||||||||||

| Susan F. Akers Born 1972 | Trustee | Since 2022 | CFO and | 7 | None | |||||||||||||||||

David J. Gruber Born 1963 | Trustee | Since 2019 | Director of Risk Advisory Services, Holbrook & Manter (CPA firm) since 2016. | 7 | Trustee for Asset Management Fund (3 Funds); Monteagle Funds (4 Funds); and | |||||||||||||||||

Michael R. Shade Born 1948 | Trustee | Since 2007 | Attorney at Law; Partner, Shade & Shade since 1979. | 7 | None | |||||||||||||||||

| NOMINEE FOR ELECTION AS NEW INDEPENDENT TRUSTEE (CURRENTLY A CANDIDATE) | ||||||||||||||||||||||

Jennifer E. Hoopes Born 1965 | None | N/A | General Counsel, Farm Together, Inc. (farmland asset management)(since 2022); Principal, Arch Consulting, LLC (compliance consulting) (since 12/2022); General Counsel, Foreside Financial Group, LLC (2007-2021). | 7 | Trustee for Equi Multi-Strategy Fund | |||||||||||||||||

| NOMINEE FOR ELECTION AS NEW INTERESTED TRUSTEE (CURRENTLY A CANDIDATE) | ||||||||||||||||||||||

Robert D. Stimpson(4) Born 1973 | None | N/A | Co-Chief Investment Officer of

| None | ||||||||||||||||||

|

| |

|

|

| ||

|

| |

SUMMARY OF THE NEW AGREEMENT

A description1 Each Trustee shall hold office during the lifetime of this Trust until the New Agreementelection and qualification of his or her successor, or until he or she sooner dies, resigns, retires or is set forth below and is qualified in its entirety by reference toExhibit A. Other than as discussed above under “Comparison of the Current Agreement and New Agreement” the following material terms of the New Agreement are the same as the Current Agreement.

General.Subject to the oversight of the Board, Oak will continue to manage the Fundsremoved in accordance with each Fund’s investment objective, restrictions and policies as stated in the Prospectus and StatementTrust’s Declaration of Additional Information. Additionally, Oak will continue to manage the investment and reinvestmentTrust.

2 The “Oak Associates Funds Complex” consist of all series of the assetsTrust for which Oak Associates, ltd. serves as investment adviser. As of each Fund, continuously review, supervise, and administerOctober 31, 2023, the investment programOak Associates Funds Complex consisted of each Fund and determine in its discretion the securitiesseven Funds.

3 Directorships of companies are required to be purchased or sold subject alwaysreport to the provisions of the Trust’s AgreementSecurities and Declaration of Trust, the Trust’s By-Laws, and the Trust’s registration statement on Form N-1A.

Compensation.For the services rendered, the Funds will pay Oak an investment advisory fee, which is payable to the Adviser at the end of each month, and calculated by applying a daily rate, based on the annual percentage rates as follows:

Brokerage.Oak has full discretion to select brokers and dealers, open securities accounts, and arrange for the placing of all orders for the purchase and sale of securities for each Fund’s account with brokers or dealers selected by Oak. In the selection of these brokers or dealers and the placing of these orders, Oak is directed at all times to seek, for each Fund, the most-favorable execution and net price availableExchange Commission under the circumstances. It also is understood that it is desirable for each Fund that Oak have access to brokerage and research services provided by brokers who may execute brokerage transactions at a higher cost to the Fund than may result when allocating brokerage to other brokers, consistent with Section 28(e) of the Securities Exchange Act of 1934 as amended and any SEC staff interpretations thereof. Oak, therefore, is authorized to place orders for the purchase and sale of securities for each Fund with these brokers, subject to review by the Board from time to time with respect to the extent and continuation of this practice. It is understood that the services provided by these brokers may be useful to the Adviser in connection with the Adviser’s(i.e., “public companies”) or the Adviser’s affiliates’ services to other clients.

Liability.Oak shall not be liable for any error of judgment or mistake of law or for any loss arising out of any investment or for any act or omission in carrying out its duties hereunder, except a loss resulting from willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of reckless disregard of its obligations and duties under the New Agreement, except as may otherwise be provided under provisions of applicable state law or Federal securities law which cannot be waived or modified.

Term.The New Agreement is expected to remain in effect from the date it is approved by shareholders and executed for an initial two-year term. Thereafter, if not terminated, the New Agreement shall continue for successive annual periods, provided such continuance is specifically approved at least annually by (i) a majority vote of the Trustees, including a majority vote of the Independent Trustees, at an in-person meeting called for the purpose of voting on said approval; or (ii) the vote of a majority of the outstanding voting securities of each Fund.

Amendment.The New Agreement may not be added to or changed orally and may not be modified or rescinded except by a writing signed by the parties to the New Agreement and in accordance with the 1940 Act, when applicable.

Termination.Under the terms of the New Agreement, Oak may terminate the New Agreement by not more than sixty (60) days’ nor less than thirty (30) days’ written notice delivered or mailed by registered mail, postage prepaid, to the Trust.

Each Fund’s advisory fees will not change under the New Agreement. For services rendered, the Funds will pay Oak an investment advisory fee, which is payable to the Adviser at the end of each month, and calculated by applying a daily rate, based on the annual percentage rates. Set forth below are the contractual investment advisory fees payable to Oak as investment adviser to the Funds and aggregate advisory fees paid to Oak during the last fiscal year.

| Fund: | Advisory Fee: | Total Advisory Fees Paid During the Fiscal Year Ended October 31, 2018 | Net Advisory Fees Paid During the Fiscal Year |

| White Oak Select Growth Fund | 0.74% | $2,330,733 | $2,330,733 |

| Pin Oak Equity Fund | 0.74% | $1,771,950 | $1,771,950 |

| Red Oak Technology Select Fund | 0.74% | $3,922,429 | $3,922,429 |

| Black Oak Emerging Technology Fund | 0.74% | $290,965 | $290,965 |

| Live Oak Health Sciences Fund | 0.74% | $476,208 | $476,208 |

| Rock Oak Core Growth Fund | 0.74% | $108,422 | $97,440 |

| River Oak Discovery Fund | 0.90% | $127,359 | $106,179 |

The Adviser has contractually agreed through February 28, 2020 or two years from the effective date of the New Agreement, whichever is later, to waive all or a portion of its fee for each of the Funds (and to reimburse expenses to the extent necessary) in order to limit Fund total operating expenses (excluding interest, taxes, brokerage commissions and “Acquired Fund” fees and expenses, as applicable), expressed as a percentage of each Fund’s average daily net assets, as follows:

INFORMATION ABOUT OAK

Oak is an investment advisercompanies registered under the Investment AdvisersCompany Act of 1940, as amended, with its principal executive office located at 3875 Embassy Parkway, Suite 250, Akron, Ohio 44333. Oak was formed in December 1995 by James D. Oelschlager to continue the business of Oak Associates, a sole proprietorship he founded in 1985 and, in addition to serving as the investment adviser to the Funds, provides advisory services to pension plans, religious and educational endowments, corporations, 401(k) plans, profit sharing plans, individual investors and trusts and estates. As of January 31, 2019, the Adviser had discretionary management authority with respect to approximately $1.71 billion of assets under management. As discussed under the “Background” section above, James D. Oelschlager and Vanita Oelschlager have agreed to the Transaction, by which they would sell substantially all of their ownership interest in the Adviser to1940.

4 Mr. R. Stimpson is considered an ownership group led by certain members of the its management team - Robert D. Stimpson, Co-Chief Investment Officer of the Adviser and Margaret L. Ballinger, Chief Compliance Officer and Chief Operating Officer of the Adviser and Carol L. Zollars, Chief Financial Officer of the Adviser. Upon consummation of the Transaction, Robert D. Stimpson, Margaret L. Ballinger and Carol L. Zollars, each an employee and officer of the Adviser, will acquire substantially all of the assets of the Adviser from James D. Oelschlager and Vanita Oelschlager, the founders of Oak. As a result of the Transaction, control of the advisory business with respect to the Funds will change from Mr. and Mrs. Oelschlager, who majority-own and control the Adviser, to Mr. Stimpson and Mmes. Ballinger and Zollars. It is expected that the Adviser will continue to employ substantially all of the firm’s existing staff following completion of the Transaction. Messrs. Stimpson and Mmes. Ballinger and Zollars collectively have over 86 years of providing investment management services. The following table lists the name and principal occupation of the principal executive officers of Oak. The address of each“interested” person in the table below is 3875 Embassy Parkway, Suite 250, Akron, Ohio 44333.

Messrs. Oelschlager and John G. Stimpson are each Trustees of the Trust and are considered “interested persons” of the Trust as that term is defined in the 1940 Act.Investment Company Act of 1940. Mr. Oelschlager holds a controlling ownership interest in the Adviser, andR. Stimpson is interested by virtue of such ownership interest. He is also interested by virtuehis role as co-Chief Investment Officer of his status as an officerOak Associates, ltd., the investment adviser to the Trust.

ADDITIONAL INFORMATION CONCERNING THE BOARD OF TRUSTEES

The Board of Trustees has responsibility for the overall management and operations of the Adviser. Mr. John G. Stimpson is considered interested because of his family relationship with an employeeTrust. The Board establishes the Trust’s policies and meets regularly to review the activities of the Adviser. Exceptofficers, who are responsible for day-to-day operations of the Trust.

The current Trustees were selected with a view towards establishing a Board that would have the broad experience needed to oversee a registered investment company comprised of multiple series. As a group, the Board has extensive experience in many different aspects of business oversight and management, including in the financial services and asset management industries.

Susan F. Akers has served as noted above, noa Trustee or officer of the Trust currently holds any position with Oak or its affiliated persons.since May 2022. Ms. Akers has experience in business and financial matters as the CFO and Principal of Ullman Oil Company. Ms. Akers is a member of the Audit and Nominating Committees and effective August 11, 2022 serves as the Chair of the Nominating Committee.

Oak provides investment subadvisory services to other funds that may have investment objectives and policies similar to those of certainJames D. Oelschlager has served as a Trustee of the Funds. The table set forth below lists such other funds advised by Oak, the net assets of those fundsTrust since its inception in 2000. Mr. Oelschlager has knowledge and experience in business matters and the subadvisory fees payable by each fundfinancial services industry as Founder of the Adviser and from serving as the Managing Member, President, and Chief Investment Officer from 1985 to Oak2019. Mr. Oelschlager has been Co-Chief Investment Officer of the Adviser since October 2014. He serves as a percentageco-manager of its average daily net assets.

| Funds Subadvised by Oak | Net Assets as of June 30, 2019 | Subadvisory Fees Payable to Oak (calculated as a percent per annum of the Fund’s average daily net assets) |

| Saratoga Technology and Communications Fund | $56,209,477 | 0.30% |

| Saratoga Health and Biotechnology Portfolio | $13,792,385 | 0.30% |

Brokerage Transactions. For the fiscal year ended October 31, 2018, the Funds did not effect any brokerage transactions in their portfolio securities with brokers who may be deemed to be affiliated personseach of the Funds and has managed White Oak Select Growth Fund since its inception in 1992. Mr. Oelschlager served as the Funds’ distributor, Director of Investment Management of a large manufacturing organization prior to founding the Adviser in 1985.

Pauline F. Ramig, Ph.D. has served as a Trustee of the Trust since 2007. Ms. Ramig has business experience and knowledge of the financial services industry from serving as a Certified Financial Planner from 1991 to 2021. Ms. Ramig is a member of the Audit and Nominating Committees. Previously, Ms. Ramig was a Manager at BP America where she was responsible for price risk management activity of its equity production portfolio, including the use of options and futures. Ms. Ramig holds B.A. and M.A. degrees in Mathematics from the University of Nebraska and the University of Louisville, respectively, and a Ph.D. in Probability and Statistics from Case Western Reserve University, where she also served as an Assistant Professor of Mathematics and Statistics. From August 11, 2022 through February 13, 2023, Ms. Ramig served as the Lead Independent Trustee. Effective February 13, 2023, Ms. Ramig serves as the Chair of the Board.

Michael R. Shade has served as a Trustee of the Trust since 2007 and is a member of the Audit and Nominating Committees. Mr. Shade has experience with various business, legal and regulatory issues from serving as an attorney and partner in the law firm of Shade & Shade since 1979.

David J. Gruber has served as a Trustee of the Trust since 2019 and is a member of the Audit and Nominating Committees. Mr. Gruber has served as the Audit Committee Chair since 2019. The Board of Trustees has determined that Mr. Gruber is an audit committee financial expert as such term is defined by Item 3 of Form N-CSR. Mr. Gruber is a CPA and served as an independent Trustee, Compliance Committee Chair, a member of the audit committee and audit committee financial expert for the Fifth Third Funds from 2003 to 2012. Mr. Gruber served as a Board member and Treasurer of CASA of Delaware County from 2009 to 2010. Mr. Gruber is an independent Trustee for Cross Shore Discovery Fund, Audit Committee Chair and Valuation Committee member, from 2014 to present. Mr. Gruber is the Chairman of the Board and an independent trustee for Asset Management Funds, and has been an Audit Committee and Valuation Committee member from 2015 to present. Mr. Gruber has also served as an independent trustee and Audit Committee Chair, of Monteagle Funds from 2015 to present. Mr. Gruber has served as Director of Risk Advisory Services for Holbrook and Manter, CPAs from January 2016 to present. Mr. Gruber was a Board member for the State Teachers Retirement System of Ohio, from 2018 to 2020. Mr. Gruber was President and Chief Executive Officer of DJG Financial Consulting, LLC from 2007 to 2015, and performed Sarbanes-Oxley assessments for public companies and served as a chief financial officer for a non-profit organization.

The following specific experience, qualifications, attributes, and/or skills apply to each Nominee: Mr. R. Stimpson, Co- Chief Investment Officer of Oak Associates, ltd., the investment adviser to the Trust (2019 – present), investment management experience as an executive and portfolio manager of the Funds since 2004; and Ms. Hoopes, senior executive, investment management and fund distribution experience as General Counsel of Foreside Financial Group, LLC (2007 – 2021).

COMPENSATION OF TRUSTEES AND OFFICERS

Interested Trustees and officers of the Trust do not receive any affiliated personsdirect compensation from the Trust. Each Independent Trustee receives an aggregate annual fee (plus reimbursement for reasonable out-of-pocket expenses incurred in connection with attendance at Board and committee meetings) from the Trust. Payment of such persons.fees and expenses is allocated between each respective Fund. If elected, Ms. Hoopes would be entitled to receive

compensation from the Trust for serving as Independent Trustee, including reimbursement for reasonable expenses incurred in attending meetings.

Section 15(f)The chart below provides information about the total compensation accrued and payable to the Independent Trustees by the Trust and the Fund Complex for the Trust’s most recently completed fiscal year, October 31, 2023. The Trust is the only investment company in the “Fund Complex.”

| Name, Position | Aggregate Compensation from the Oak Associates Funds | Total Compensation from Trust and Fund Complex Paid to Trustees |

| Susan F. Akers, Independent Trustee | $52,500 | $52,500 |

| David J. Gruber, Independent Trustee | $55,500 | $55,500 |

| Pauline F. Ramig, Ph.D., Independent Trustee | $66,250 | $66,250 |

| Michael R. Shade, Independent Trustee | $51,750 | $51,750 |

| James D. Oelschlager, Interested Trustee | None | None |

OWNERSHIP OF FUND SECURITIES

The table below shows the dollar range of equity securities beneficially owned by each Nominee, as of December 31, 2023, in each Fund of the 1940Trust and all registered investment companies to be overseen by such Nominee in the Trust's "family of investment companies," which, as of the date of this Proxy Statement, included the seven Funds of the Trust. Dollar amount ranges disclosed are established by the SEC. “Beneficial ownership” is determined in accordance with Rule 16a-1(a)(2) under the Securities Exchange Act of 1934, as amended.

| Name | Dollar Range of Fund Shares (Fund) | Aggregate Dollar Range of Shares (All Funds) |

| INTERESTED TRUSTEE NOMINEE | ||

| R. Stimpson | White Oak – Over $100,000 | Over $100,000 |

| Pin Oak – Over $100,000 | ||

| Red Oak – Over $100,000 | ||

| Live Oak – Over $100,000 | ||

| Black Oak – Over $100,000 | ||

| Rock Oak – Over $100,000 | ||

| River Oak – Over $100,000 | ||

| INDEPENDENT TRUSTEE NOMINEES | ||

| Akers | White Oak – None | None |

| Pin Oak – None | ||

| Red Oak – None | ||

| Live Oak – None | ||

| Black Oak – None | ||

| Rock Oak – None | ||

| River Oak – None | ||

| Gruber | White Oak – None | $10,001-$50,000 |

| Pin Oak – $1-$10,000 | ||

| Red Oak – $1-$10,000 | ||

| Live Oak – $1-$10,000 | ||

| Black Oak – None | ||

| Rock Oak – $1-$10,000 | ||

| River Oak – None | ||

| Hoopes | White Oak – None | None |

| Pin Oak – None | ||

| Red Oak – None | ||

| Live Oak – None | ||

| Black Oak – None | ||

| Rock Oak – None | ||

| River Oak – None | ||

| Shade | White Oak – $50,001 - $100,000 | Over $100,000 |

| Pin Oak – $50,001 - $100,000 | ||

| Red Oak – Over $100,000 | ||

| Live Oak – $50,001 - $100,000 | ||

| Black Oak – $50,001 - $100,000 | ||

| Rock Oak – $10,001 - $50,000 | ||

| River Oak – $10,001 - $50,000 |

MEETINGS AND COMMITTEES OF THE BOARD OF TRUSTEES

Section 15(f)MEETINGS OF THE BOARD OF TRUSTEES. During the Trust’s most recently completed fiscal year, the Board of Trustees met four times. The Trust does not have a policy with respect to the Trustees' attendance at meetings, but as a matter of practice all of the 1940 Act providesTrustees attend the Trust's Board meetings (in-person or by telephone) to the extent possible. None of the Trustees attended fewer than 75% of the aggregate amount of meetings of the Board and Board committees for which they were eligible to attend.

AUDIT COMMITTEE. The Board has a safe harborstanding Audit Committee that is composed entirely of the Independent Trustees of the Trust. The Audit Committee operates under a written charter approved by the Board. The principal responsibilities of the Audit Committee include: recommending which firm to an investment adviser who may receiveengage as the Trust’s independent registered public accountants and whether to terminate this relationship; reviewing the independent registered public accountants’ compensation, or benefitsthe proposed scope and terms of its engagement, and the firm’s independence; pre-approving audit and non-audit services provided by the Trust’s independent registered public accountants to the Trust and certain other affiliated entities; serving as a channel of communication between the independent registered public accountant and the Trustees; reviewing the results of each external audit, including any qualifications in the independent registered public accountants’ opinion, any related management letter, management’s responses to recommendations made by the independent registered public accountants in connection with the sale of securities or a sale of any other interest inaudit, reports submitted to the investment adviser, which results in an assignment of an investment advisory contract onCommittee by the satisfaction of two conditions. The first condition specifies that, during the three-year period immediately following completioninternal auditing department of the transaction, at least 75% ofTrust’s Administrator that are material to the investment company's board of trustees must not be "interested persons" (as defined in the 1940 Act) of the investment adviser or predecessor adviser. During the three-year period immediately following the completion of the Transaction, it is anticipated that at least 75% of the Trustees will not be "interested persons" (as defined in the 1940 Act) of Oak. The second condition specifies that no "unfair burden" may be imposed on the investment companyTrust as a result of the transaction orwhole, if any, express or implied terms, conditions or understandings applicableand management’s responses to the transaction. The term "unfair burden," as defined in the 1940 Act, includes any arrangement, during the two-year period after the transaction occurs, whereby the investment adviser (or predecessor or successor adviser), or any interested person of any such adviser, receives or is entitled to receivereports; reviewing the Trust’s audited financial statements and considering any compensation, directly or indirectly (i) from any personsignificant disputes between the Trust’s management and the independent registered public accountants that arose in connection with the purchase or salepreparation of securities or other property, to, from orthose financial statements; considering, in consultation with the independent registered public accountants and the Trust’s senior internal accounting executive, if any, the independent registered public accountants’ report on behalfthe adequacy of the investment company (other than bona fide ordinary compensationTrust’s internal financial controls; reviewing, in consultation with the Trust’s independent registered public accountants, major changes regarding auditing and accounting principles and practices to be followed when preparing the Trust’s financial statements; and other audit related matters. Mr. Gruber serves as principal underwriter for the investment company) or (ii) from the investment company or its security holders for other than bona fide investment advisory or other services. Oak will not impose or seek to impose on the Funds any "unfair burden" as a resultChair of the Transaction.

BOARD CONSIDERATION IN APPROVING THE NEW AGREEMENT

Before considering the New Agreement, theAudit Committee. The Board of Trustees (“Board” or “Trustees”), includinghas determined that Mr. Gruber is an audit committee financial expert as such term is defined by Item 3 of Form N-CSR. The Audit Committee meets periodically, as necessary, and met two times in the Trustees who are not “interested persons” (“Independent Trustees”) within the meaning of Section 2(a)(19) of the 1940 Act, requested information about the Transaction and the resultant change of control. In determining whether to approve the New Agreement, the Trustees considered information provided by Oak in conjunction with the August 14, 2019 in-person meeting of the Board. At the in-person meeting, themost recently completed fiscal year.

NOMINATING COMMITTEE. The Board includinghas a majoritystanding Nominating Committee that is composed entirely of the Independent Trustees unanimously approved the New Agreement.

In determining whether to approve the New Agreement, the Trustees re-considered their recent deliberations made in discussions which began at the pre-15(c) meeting special meeting of the Independent Trustees held on January 28, 2019 and which were continued at the meetingTrust. The principal responsibilities of the Trustees heldNominating Committee are to consider, recommend and nominate candidates to fill vacancies on February 10-11, 2019 with respectthe Trust’s Board, if any. The Nominating Committee will review all shareholder recommendations for nominations to fill vacancies on the Current Agreement and deliberated upon updated and supplemental information. The Trustees also considered a wide variety of information from the Adviser, including information provided by the Adviser in response to a request from counsel on behalf of the Trustees in accordance with Section 15(c) of the 1940 Act, to assist in their deliberations as well as information received throughout the year, bothBoard if such recommendations are submitted in writing and during meetings, regarding the Funds, including Fund performance, expense ratios, portfolio composition and regulatory compliance (the “Adviser Materials”). Prioraddressed to the in-personCommittee at the Trust’s office. The Nominating Committee meets periodically, as necessary, and met once in the most recently completed fiscal year. The Board meeting held in August,has adopted and approved a formal written charter for the Independent Trustees held a special meeting on August 9, 2019Nominating Committee. A copy of the Nominating Committee Charter is included herein as Appendix A.

COMMUNICATIONS WITH THE BOARD

Shareholders wishing to discuss the Adviser Materials. Following the August 9, 2019 meeting, the Independent Trustees, with the assistance of their independent legal counsel, requested that the Adviser provide additional informationsubmit written communications to the Trustees forBoard should send their communications to the meeting held on August 14, 2019. In addition, the Independent Trustees discussed and considered the Adviser Materials and the approvalSecretary of the New Agreement in an executive session ofTrust at 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. Any such communications received will be reviewed by the Independent Trustees held during the August 14, 2019 meeting as well as during the regular course of the meeting, and received counsel from their independent legal counsel.Board at its next regularly scheduled meeting.

VOTING REQUIREMENT FOR SHAREHOLDER APPROVAL OF THE ELECTION OF TRUSTEES

At the August meeting, representatives from Oak joined the meeting and discussed the Transaction, including the background of and reasons for the Transaction. They also discussed Oak’s history, performance, investment strategy, and compliance program in connection with theSpecial Meeting, it is proposed New Agreement. Representatives of Oak responded to questions from the Board. The Board members also inquired about the plans for, and the new management roles and responsibilities of, certain employees and officers of Oak as a result of the change of control. In connection with the Trustees’ review of the New Agreement, the representatives from Oak emphasized that: (i) it expected that there will be no adverse changes as a result of the change of control in the nature, quality, or extent of services currently provided to the Funds and their shareholders, including investment management, distribution, or other shareholder services; (ii) no material adverse effects on Oak’s financial condition; (iii) no material changes in personnel or operations are contemplated; and (iv) Oak has no present intention to alter the expense limitations and reimbursements currently in effect for each Fund. The Board also noted that it had previously reviewed and considered certain materials and presentations provided by the Adviser, which had contained information that assisted the Trustees in assessing the Adviser’s investment advisory services, its investment process and regulatory/compliance capabilities and record, as well as the Adviser’s investment philosophy, Fund performance records, and trade execution capabilities. The Board also noted that it had previously considered certain non-advisory services provided to the Funds, such as the services of Adviser employees as Trust officers and other personnel provided that are necessary for Fund operations, including the services of the Trust’s Chief Compliance Officer provided to the Funds at no cost to the Funds and certain employees of the Adviser serving as Trust officers overseeing and managing the other Fund service providers.

In addition to the information provided by Oak, the Trustees also considered all other factors they believed to be relevant to evaluating the New Agreement, including the specific matters discussed below. In their deliberations, the Trustees did not identify any particular information that was controlling, and different Trustees may have attributed different weights to the various factors. However, the Trustees determined that the overall arrangements between each Fund and Oak,five Nominees be elected as provided in the New Agreement, including the proposed advisory fees, are fair and reasonable in light of the services to be performed, expenses incurred and such other matters as the Trustees considered relevant. Factors evaluated included: (i) the differences and similarities between the Current Agreement and the New Agreement, noting specifically that the New Agreement is not intended to change the existing relationship of the Trust to hold office until their successors are appointed or duly elected and qualified, or until he or she sooner dies, resigns, retires or is removed in accordance with the Adviser; rather, the New Agreement is intended to more specifically define the rights and obligationsTrust’s Declaration of the advisory relationship that currently exists; (ii) the Board’s full annual reviewTrust. The election of the Current Agreement at the in-person meeting held on February 10-11, 2019 as required by the 1940 Act and their determination at that time that (a) Oak had the capabilities, resources, and personnel necessary to provide the satisfactory advisory services currently provided to each Fund and (b) the advisory fees paid by such Fund, taking into account any applicable fee limitations, represent reasonable compensation to Oak in light of the services provided, the costs to Oak of providing those services, economies of scale, and the fees and other expenses paid by similar funds and such other matters that the Board considered relevant in the exercise of their reasonable judgment; and (iii) the operations of Oak are not currently expected to changea Nominee as a result of the change of control. Certain of these considerations are discussed in more detail below. As part of the Board’s decision-making process, the Board considered the nature, extent, and quality of the services historically provided to each of the Funds by the Adviser. In reviewing the nature, extent, and quality of services, the Board considered that the New Agreement was not intended to change the existing relationshipTrustee of the Trust withrequires the Adviser; rather,affirmative vote of a plurality of all votes cast at the New Agreement incorporates certain additional provisionsSpecial Meeting, provided that memorialize and make explicit certain functions and dutiesa quorum is present, in person or by proxy, at the Special Meeting. IF YOU RETURN YOUR PROXY BUT GIVE NO VOTING INSTRUCTIONS, YOUR SHARES WILL BE VOTED "FOR" ALL NOMINEES NAMED HEREIN. If the Nominees are not approved by shareholders of the Adviser that were implicitTrust, the current Board of Trustees will remain in the Current Agreementplace and incorporates certain regulatory developments. The Board therefore considered presentations by Trust officers and representatives of the Adviser during the year at regular Board meetings covering matters such as the relative performance of the Funds; compliance with the investment objectives, policies, strategies, and limitations for the Funds; the compliance of management personnel with the applicable code of ethics; and the adherence to fair value pricing procedures as established by the Board. The Trustees considered Oak’s personnel and the depth of Oak’s personnel who possess the experience to provide investment management services to the Funds, and noted that, based on the information provided by Oak, no material changes are expected as a result of the change of control in Oak’s personnel or operations. The Board noted that the Adviser has managed the Funds since their inception, and the Board believes that a long-term relationship with a capable, conscientious investment adviser is in the best interest of the Funds. The Board also considered that shareholders invest in a Fund specifically seeking the Adviser’s investment expertise and style. The Board also noted that when shareholders invest in a Fund, they know the advisory fee that is paid by the Fund. In this regard, the Board considered, in particular, that each Fund is managed in accordance with its investment objective and policies as disclosed to shareholders.

The Trustees also considered performance information in the Adviser Materials for Oak and each of the Funds. Although the Trustees gave appropriate consideration to performance reports and discussions with portfolio managers at Board meetings throughout the year, the Trustees gave particular weight to their review of investment performance presented in connection with the approval of the New Agreement at the August 14, 2019 in-person meeting and the annual approval of the continuation of the Current Agreement at the February 10-11, 2019 in-person meeting. The Trustees considered the investment performance of each Fund. The Trustees reviewed presentations by the Adviser’s portfolio managers for each Fund as well as a report prepared by the Trust’s administrator that provided performance information for the three month, year-to-date, one year, three year, five year, ten year and since inception periods ended June 30, 2019 (as applicable to each Fund), including information comparing each Fund’s performance to that of each Fund’s benchmark index and peer funds as categorized by Lipper Inc. (“Lipper”) and Morningstar, Inc. (“Morningstar”), both independent sources of investment company data. The Trustees considered the investment performance for the Funds and Oak. as compared to each Fund’s benchmark, peer group averages and any applicable comparable funds or accounts managed by the Adviser for the one year, three year, five year, ten year and since inception periods (as applicable to each Fund) ending as of June 30, 2019. The Trustees also noted that they had previously evaluated the performance of the Adviser’s separate accounts relative to the White Oak Fund, the River Oak Fund, the Pin Oak Fund and the Red Oak Fund, and in the case of the Red Oak Fund and the Live Oak Fund, to a similarly managed fund for which the Adviser serves as sub-adviser.

The Trustees also reviewed the Adviser’s commentary regarding the performance data and the various factors contributing to each Fund’s short- and long-term performance. The Trustees took note of the various periods where each Fund outperformed, underperformed or performed in line with its respective peer group averages and benchmark. The Trustees noted that several of the Funds’ relative performance was positive and generally favorable for the one year period ended June 30, 2019 except for the Rock Oak Fund, River Oak Fund and Black Oak Fund, each of which had negative performance. For the one year period ended June 30, 2019, the Red Oak Fund underperformed its benchmark but outperformed its peer group averages; and the White Oak Fund, Pin Oak Fund, Rock Oak Fund, River Oak Fund, Black Oak Fund and the Live Oak Fund each underperformed their respective benchmarks and peer group averages. For certain of the other longer-term periods ended June 30, the Trustees noted that the White Oak Fund, the Pin Oak Fund, the Rock Oak Fund and the Red Oak Fund outperformed certain of their respective benchmarks and peer group averages, and underperformed for others; while the River Oak Fund, the Black Oak Fund and the Live Oak each lagged in all categories over these same longer term periods. In the case of each Fund with performance that lagged a relevant peer group or benchmark for certain periods (but not necessarily all periods), the Trustees considered explanations provided by the Adviser regarding the various factors contributing to the relative underperformance of such Fund, including, among other things, differences in a Fund’s respective investment strategies and portfolio construction in comparison to the funds included in its respective Morningstar and Lipper peer groups. Further, the Board discussed with the Adviser the reasons behind such results for each applicable Fund. In addition, the Trustees considered other factors that supported the approval of the New Agreement, including the following: (i) that the Adviser’s investment decisions, such as security selection and sector allocation, contributing to such underperformance were consistent with each Fund’s respective investment objective and policies; (ii) that shorter-term or longer-term performance, as applicable, was competitive when compared to the performance of relevant peer groups or benchmarks; and (iii) that many of the Funds’ peers are larger in size than the corresponding Fund, including that this factor may impact the relative performance of the Funds. Taking note of the Adviser’s discussion of (i) the various factors contributing to each Fund’s performance and (ii) its continuing commitment to each Fund’s current investment strategy, the Independent Trustees concluded that the investment performance of each Fund was sufficient based on the information provided at the August 14, 2019 in-person meeting. The Trustees considered the advisory fees paid to the Adviser, the total expense ratios of each Fund, and the Adviser’s commitment to continue to waive its advisory fees and/or reimburse Fund expenses in order to maintain stated caps on Fund operating expenses. The Trustees reviewed presentations by Trust officers, including information about the reported fees and expenses of each Fund’s peer funds compiled by the Trust’s administrator from data obtained from Lipper. The Trustees also received information from the Adviser regarding compensation arrangements for other accounts managed by the Adviser, and evaluated the explanations provided by the Adviser as to differences in fees charged to the Funds and such accounts. The Trustees noted that the Adviser waived a portion of its advisory fee with respect to each of the Rock Oak Fund and the River Oak Fund in order to maintain the stated cap on Fund operating expenses. The Independent Trustees further considered the Adviser’s profitability derived from its relationship with the Trust on a Fund-by-Fund basis, based on information reported by the Adviser, including information regarding the financial condition of the Adviser. The Independent Trustees concluded that each Fund’s advisory fee set forth in the Advisory Agreement was reasonable and did not result in an excessive profit to the Adviser in relation to the nature, extent and quality of services provided. The Independent Trustees also concluded that the overall expense ratio for each Fund is reasonable in comparison to the average expense ratio of funds in each Fund’s respective Lipper category, and in light of various factors, such as Fund size and quality of service.

The Trustees considered the information provided by the Adviser with respect to potential “fall out” benefits to the Adviser from its relationship with the Funds, such as benefits to the Adviser in receipt of research paid for with Fund commissions (i.e., soft dollars) and in attracting and retaining non-Fund advisory clients. The Trustees also reviewed additional information provided by the Adviser in connection with their follow-up question on the Adviser’s estimated annual soft dollar commitment. The Trustees considered the information they were provided about the Adviser’s portfolio brokerage practices on behalf of the Funds, including its policies with respect to obtaining benefits from use of the Funds’ brokerage commissions to obtain research that also could be used for the Adviser’s other clients, and the Independent Trustees concluded that the Adviser’s portfolio brokerage practices appeared to be reasonably designed to achieve best execution on Fund trades.

The Trustees considered whether there were economies of scale in managing the Funds, and in light of the relatively small size of the Funds and the Adviser’s commitment to waive its advisory fees and/or reimburse Fund expenses in order to maintain stated caps on the Funds’ operating expenses, determined that such economies of scale were not present. As such, the Trustees did notwill consider whether any economies of scale were adequately shared with Fund shareholders.

In voting to approve the New Agreement, the Board considered all factors it deemed relevant, including the Adviser Materials. In arriving at its decision, the Board did not identify any single factor as being of paramount importance and each member of the Board gave varying weights to each factor according to his or her own judgment. The Board determined that the approval of the New Agreement would be in the best interests of each Fund and its shareholders. As a result, the Board, including a majority of the Independent Trustees, unanimously approved the New Agreement for each Fund.alternative nominations.

THE BOARD OF TRUSTEES, INCLUDING THE TRUST’S INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS OF EACH FUNDYOU VOTE “FOR” EACH OF THE PROPOSAL TO APPROVE THE NEW AGREEMENT.

* * *NOMINEES.

ADDITIONAL INFORMATION

Additional Service ProvidersTRUST OFFICERS

The service providers currently engagedofficers of the Trust, their respective dates of birth, and their principal occupations for the last five years are set forth below. Unless otherwise noted, the business address of each officer is Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. None of the officers receive compensation from the Trust for their services.

| · | CHARLES A. KIRALY (Born 1969) – President since July 2014 – Director of Mutual Fund Operations at Oak Associates, ltd. since July 2014. |